Fuel campaign performance with laser-focused targeting

![COVID-19 Impact on Mobile User Behavior [App Install Insights]](https://i.l.inmobicdn.net/website/website/6.0.1/uploads/blog/Blog_Image3.jpg)

The world is in the midst of an unprecedented global pandemic, as the novel coronavirus spreads rapidly. In the U.S., many state, county and city authorities have issued shelter in place orders to try to “flatten the curve” and prevent the number of new COVID-19 cases from spiking.

For most Americans, the most dramatic and noticeable effect of COVID-19 has been social distancing. With people staying inside for weeks, many are turning to their screens for news, comfort, connection and more.

For a closer look at the role mobile apps are playing in helping people navigate this crisis, we turned to InMobi’s intelligence solutions, using our first-party telco data to review new app install trends from end of December 2019 through the first three weeks of March 2020. Here’s what we uncovered.

In March, thousands of Americans rushed to supermarkets and big box chains to stock up on essentials like toilet paper and pasta in preparation for spending additional time at home. But instead of fighting the lines at grocery stores or trying to grab supplies off shelves before they ran out, many people opted to just order items for their house on their phone. In fact, compared to January 2020 figures, new installs of Instacart, Shipt and Drizly were, combined, up 166% in March.

In early March, the number of new Instacart app installs jumped to an all-time high for the year. More specifically, the number of new Instacart app installs increased 51% in February and 49% in the first three weeks of March. Instacart has long been one of the biggest brand names in this space, so it’s not surprising to see them with the greatest number of new users in this time of social distancing.

Shipt, a grocery delivery app owned by Target, also saw a boost in new users at this time. The number of new Shipt app installs increased 34% in February and 37% in the first three weeks of March, and the number of new app installs for the beverage delivery brand Drizly increased 52% in February and 39% in March.

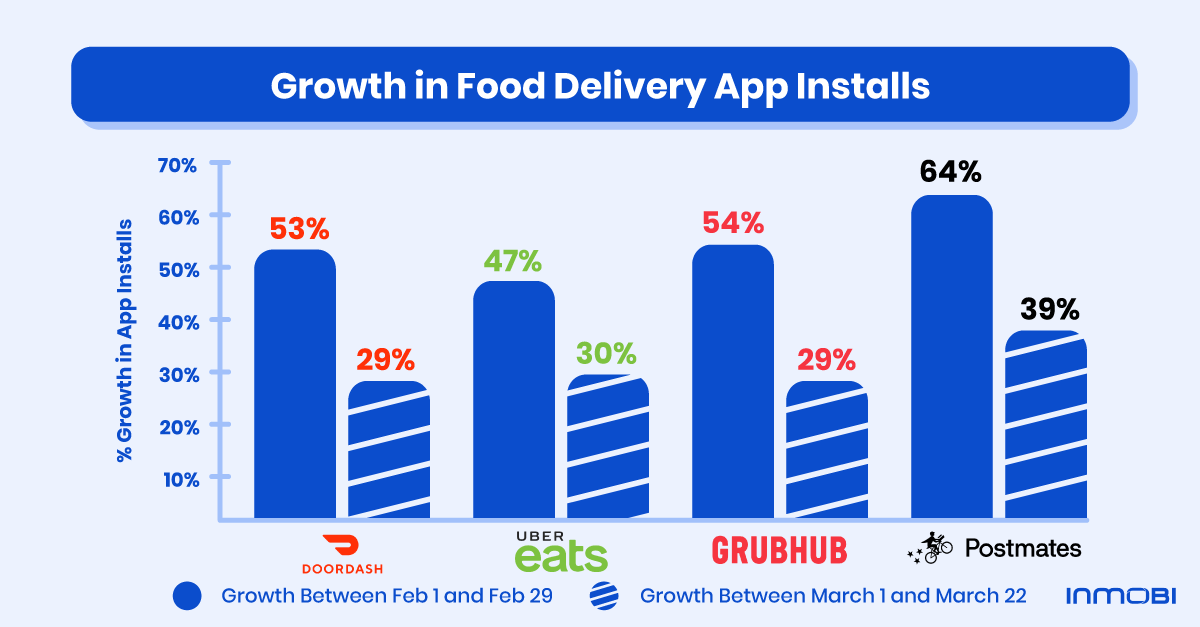

Of course, Americans weren’t only getting their groceries delivered. With restaurants only allowed to open for to-go and delivery orders in many parts of the U.S., many people opted to have their meals delivered to them. Starting at the end of February and continuing into March, the number of new users rose for GrubHub, DoorDash, Uber Eats and Postmates. In early March, new installs of these four apps were up 60%.<

The number of new Doordash app installs increased 53% in February and 29% in the first three weeks of March, while new GrubHub app installs increased 54% in February and 29% in the first three weeks of March. Uber Eats saw 30% new installs in the first three weeks of March.

The growth in March was especially pronounced for Postmates, which may be because the Postmates apps can be used for deliveries beyond just already-made restaurant meals. Postmates has also continued some marketing efforts at this time, which may have helped them see a boost of new users as well. The number of new Postmates app installs increased 64% in February and 39% in the first three weeks of March.

In March, with huge chunks of the U.S. populace stuck indoors, many people are turning to apps to keep themselves entertained. For example, usage of music apps Musi, Groovepad, DrumPad and youngRadio was up 100% in March over January.

In the streaming music space, Pandora has seen a spike of new app installs throughout March so far. It will be interesting to see how audio app usage progresses over March. Apps like Spotify have made a number of investments of lare around podcasts, which are often associated with commutes. It remains to be seen if consumers will pivot to audio for entertainment, or if video will remain ascendant.

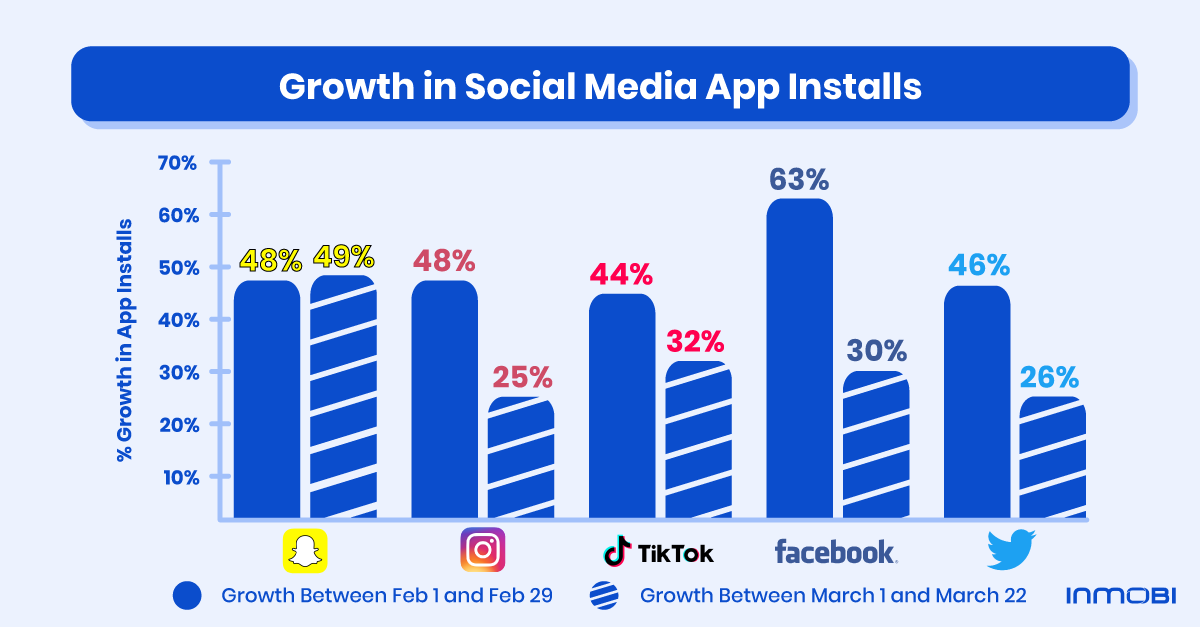

Many people are turning to social media apps right now too. Across the bulk of March, combined installs of Snapchat, TikTok, Instagram, Twitter and Facebook was up 23% from January 2020.

TikTok saw 32% more new app installs in the first three weeks of March, while Snapchat had 49% more new app installs in the same period. The number of new Instagram app installs increased 48% in February and 25% in the first three weeks of March. Seemingly, social apps that are used more for entertainment saw more new users compared to social apps that feature a heavy dose of news as well.

On the video side, YouTube has seen an increase in new mobile app installs in March, as has gaming-focused video platform Twitch. And, by mid-March, new installs of Netflix, Hulu, Tubi TV and Pluto TV were combined up 33% from the beginning of the year. This again shows an increased interest in pure entertainment content among consumers during this period.

Gaming apps have seen an increase in new users as well. By the second week of March, new installs of Candy Crush, Coinmaster, Foxnext, Peakgames and Subway Surfers were up 95% from January 2020 totals. And, by the second half of March, usage of CoinMaster, Daily Themed Crossword Puzzle and Words with Friends was up 67% from the beginning of the year.

What about exercise? Are Americans turning to apps to stay healthy? MyFitnessPal saw a notable jump in new installs in March, and Strava saw a small increase in the month as well. But, both MyFitnessPal and Peloton saw a larger increase in new app installs at the beginning of January — likely for New Year’s resolutions.

There are few trends at play here. It’s not surprising to see both Peloton and MyFitnessPal see a marked increase in users at the beginning of the year, as many people aim to start the year being healthier, only to see their resolutions fall off over time. Many fitness-related brands, like Peloton, also ran major marketing campaigns specifically in January to capitalize on New Year’s Resolutions.

So why isn’t Peloton seeing a spike in usage in March? Not only are they not marketing themselves as heavily as before, but it’s also definitely possible that people are less interested in exercising right now as they are ordering meals or watching video content. Of course, a new Peloton order usually requires an in-home technician to setup, which is not good for social distancing.

What about March trends in the space? Outdoor-focused apps like Strava tend to not see major increases in usage when it’s cold outside across much of the country, even though outdoor exercise is one of the only activities allowed out of the home in areas with shelter in place orders. Should the virus continue to dramatically impact American life into May and June, then it’s definitely possible for these outdoor-oriented apps to see a larger-than-normal spike in new users.

In comparison to some other apps like Strava, MyFitnessPal also includes a diet and nutrition component. This could be part of why they have more new users compared to other properties in this space.

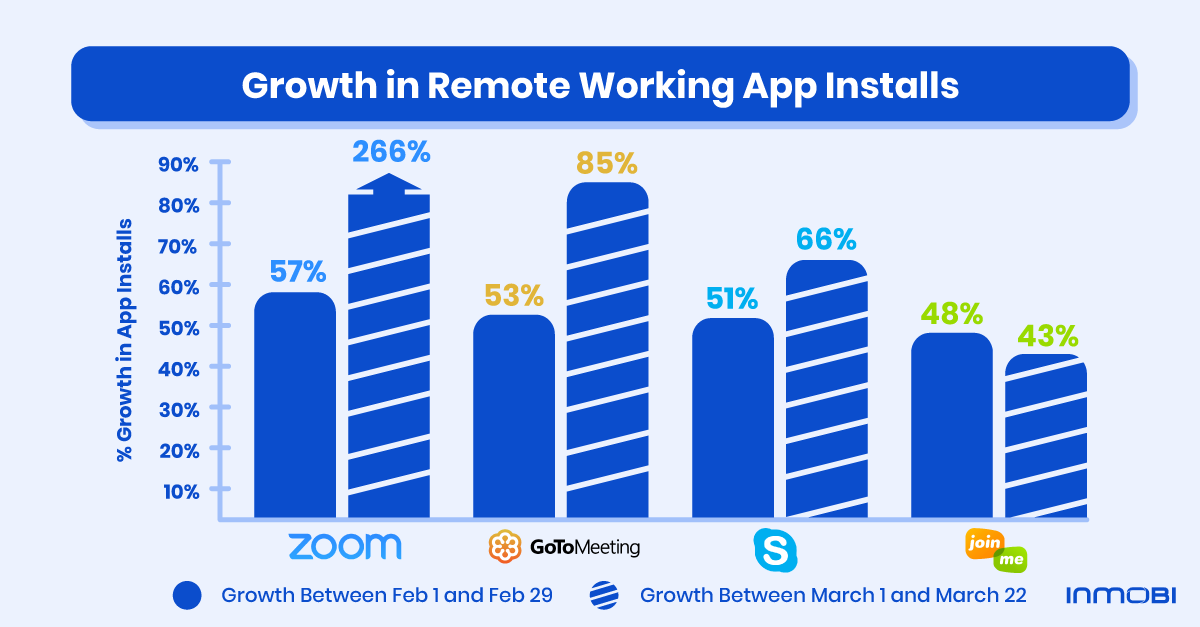

As a result of the novel coronavirus, many workplaces are having their employees work from home. This has led to a sharp spike in new app installs for Zoom during the middle of March, also with a notable uptick for Skype for Business, GoToMeeting and Join.me. In fact, between March 11 and March 22, total new installs of these four apps grew 2000% over January totals.

Why is Zoom in particular seeing so much lift? They have received a lot of news coverage recently as working from home becomes the norm in many industries. And, Zoom has been increasingly used for distance social events. Even brands like Chipotle are leveraging Zoom right now as part of an overall push around social distancing.

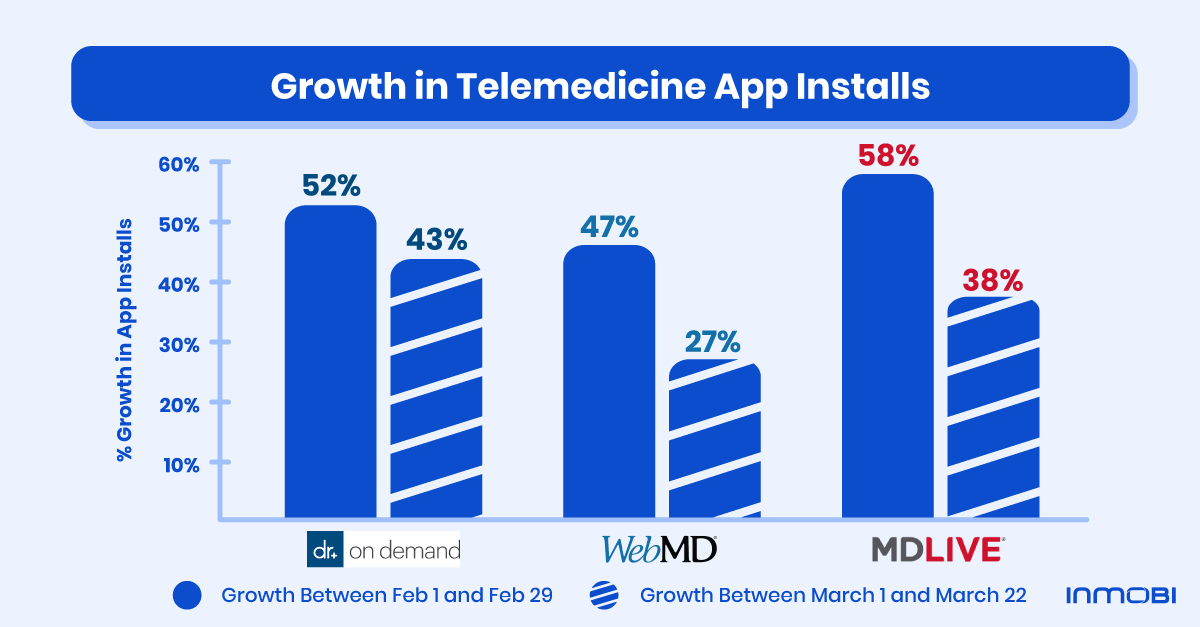

There has also been a spike in telemedicine app users of late, with medical offices looking to avoid in-person contact unless necessary and with patients preferring to stay away from sick people. Doctor On Demand, WebMD and MDLive have all seen a jump in new app installs in March, although it is worth noting that some medical professionals are using consumer-facing tools like Zoom and Apple’s FaceTime now as well. Still, total new installs of these three telemedicine-specific apps was up 70% in March compared to January 2020.

It remains to be seen just how the novel coronavirus will spread in the U.S. and what its impact will be in the end. But, for as long as people are social distancing themselves, mobile phones will play a critical role in how people shop, entertain themselves, work and communicate.

InMobi takes user privacy extremely seriously. We meet the most rigorous governance, compliance, and security standards. We have collaborated with consumer advocacy groups and incorporate guidelines from multiple federal government agencies to define industry-leading practices for data governance in the U.S.

Users retain complete control over the data they provide, have a choice in whether they participate and have transparency as to how their data is utilized. Subscribers have constant access to their privacy elections through multiple telco touchpoints. The patented anonymization platform ensures data sets are 100% secure, and are refreshed to ensure all data are anonymized.

Register to our blog updates newsletter to receive the latest content in your inbox.