Fuel campaign performance with laser-focused targeting

COVID-19 has led the world into a new normal and almost all sectors of the economy were disrupted as restrictions were imposed. As a result, advertisers across verticals are pivoting brand awareness messaging to match consumer sentiments.

Now more than ever, the success of a digital campaign depends on addressing the most relevant audiences and driving the most relevant KPIs.

In this Q&A, we chat with Bismit Bikash Boruah, Director, Programmatic Marketplace at InMobi, and look into changing trends we’re seeing on InMobi Exchange our leading in-app exchange. Listen in to the 32-minute conversation today!

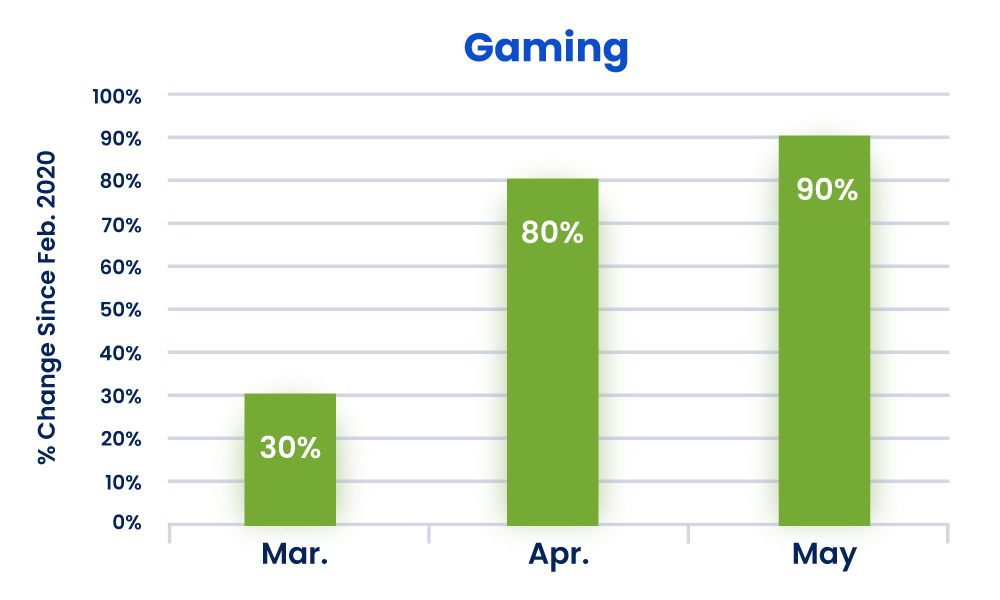

Spending in mobile gaming grew in May by 90% compared to February.

Key Takeaways:

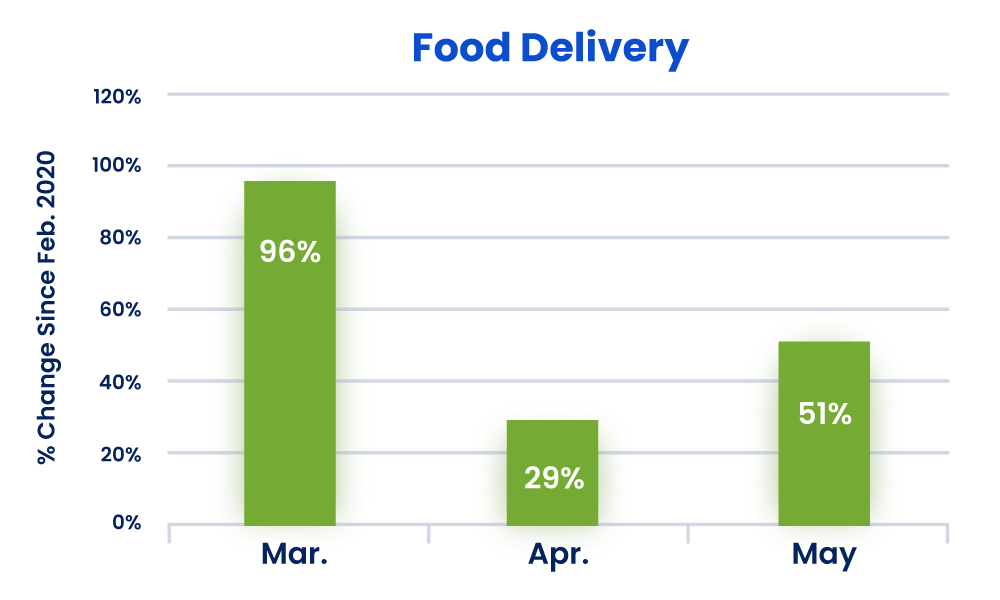

Food delivery has seen a huge increase while QSR spending remains down.

Key Takeaways:

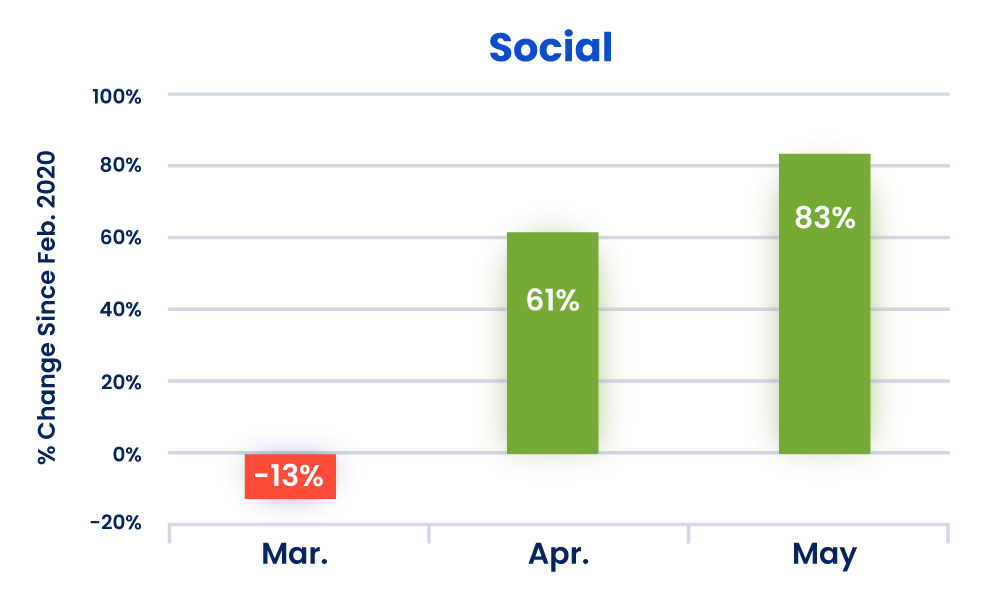

Spending for social platforms significantly dipped in March but quickly recovered, with May spending increasing by 83% since February.

Key Takeaways:

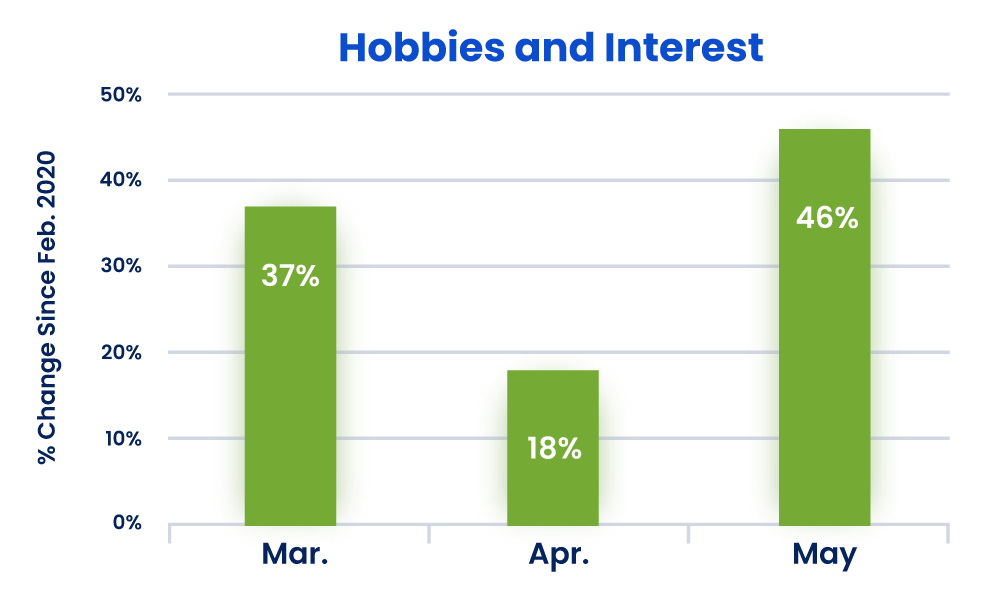

Spending in this category has been up, with a 46% increase in May compared to February.

Key Takeaways:

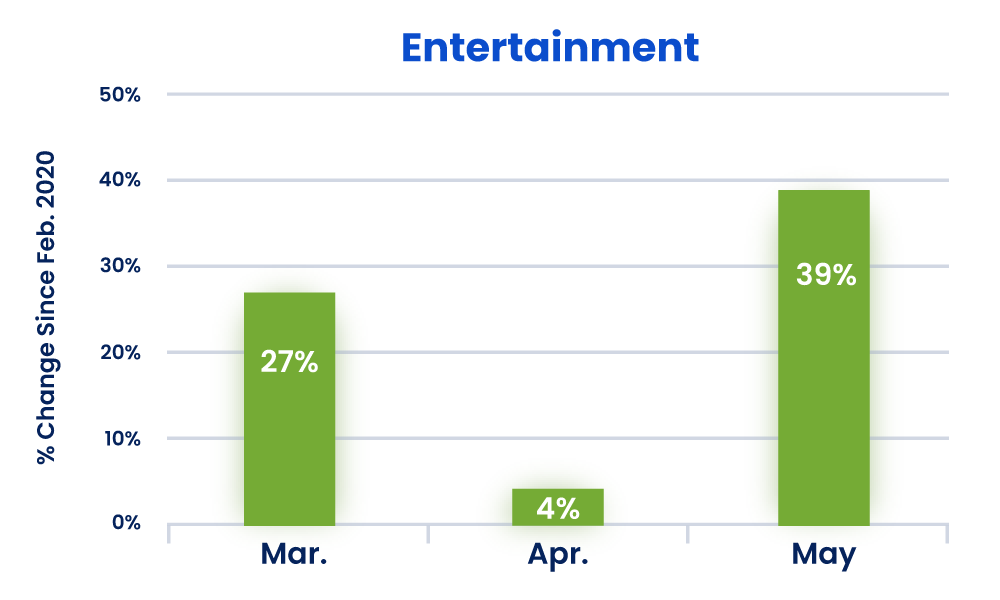

Entertainment spending initially rose in March, slowed in April and increased sharply in May.

Key Takeaways:

Interested in listening to more interviews just like this one? Click the links below to tune in.

Matthew Kaplan has over a decade of digital marketing experience, working to support the content goals of the world’s biggest B2B and B2C brands. He is a passionate app user and evangelist, working to support diverse marketing campaigns across devices.

Register to our blog updates newsletter to receive the latest content in your inbox.