Fuel campaign performance with laser-focused targeting

![How COVID-19 is Impacting Americans [Mobile Survey Data]](https://i.l.inmobicdn.net/website/website/6.0.1/uploads/blog/coronavirus-mobile-survey-data-inmobi.jpg)

Throughout February and March, the novel coronavirus has quickly spread throughout the U.S., causing sudden disruption to everyday life. To get a sense of the ways in which it is impacting Americans, InMobi ran a mobile survey using InMobi Pulse, InMobi’s mobile market research solution.

The survey ran from March 19-22 and reached more than 2,500 people across the country. Over a confirmed third of all survey respondents were from the states that had the 10 most confirmed cases of COVID-19 as of March 24.

Here’s what the data revealed:

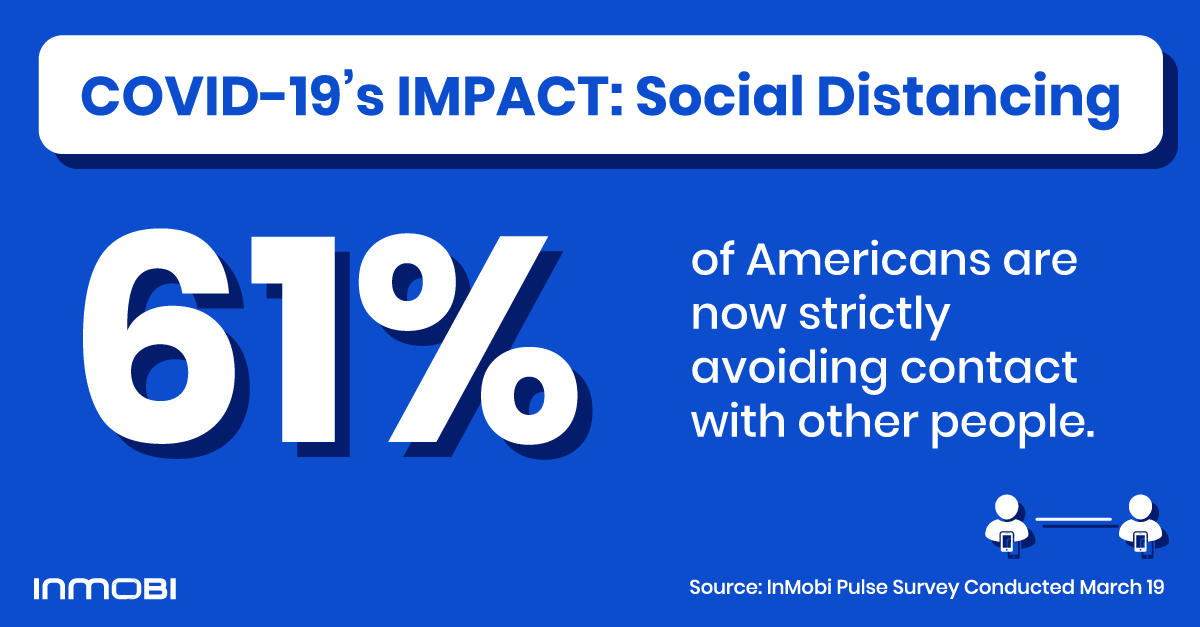

As a result of the novel coronavirus, the vast majority of Americans report staying away from others right now. Overall, 61% of survey respondents said they are very strictly avoiding contact with other people, while an additional 27% said they have somewhat avoided contact with others at the moment.

Attitudes vary by age and gender though. While 54% of men said they have very strictly reduced contact with others, 67% of women said the same thing. And, while only 46% of survey respondents between 18 and 25 said they have very strictly reduced contact with others, 73% of those who are 66 years old and older said they are taking this precaution right now.

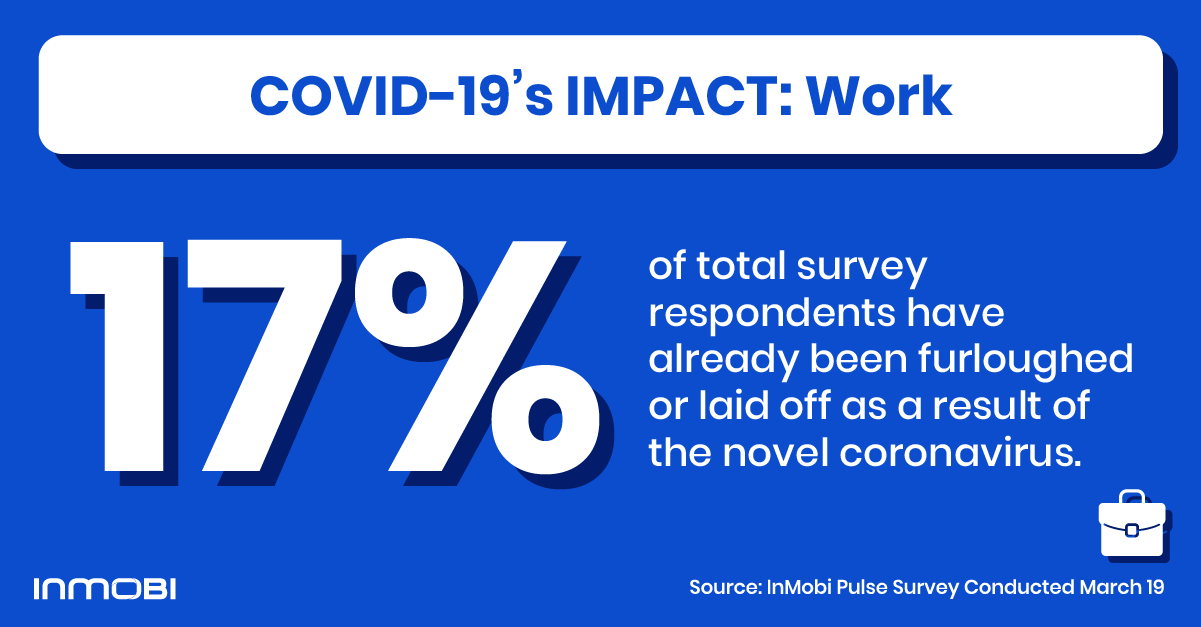

Between social distancing and the virus’s still-developing impact on the economy, COVID-19 has dramatically upended work so far. According to our research, 17% of total survey respondents (and 21% of survey respondents between the ages of 18 and 25) have already been furloughed or laid off as a result of the novel coronavirus– and this figure is likely to rise in the weeks ahead.

Further, over a quarter of those polled said they are working from home as a result of COVID-19. Those now working from home (whether mandatory or optional) are largely using conferencing/voice call (35%) and/or Zoom (31%) to stay in touch with colleagues and keep working.

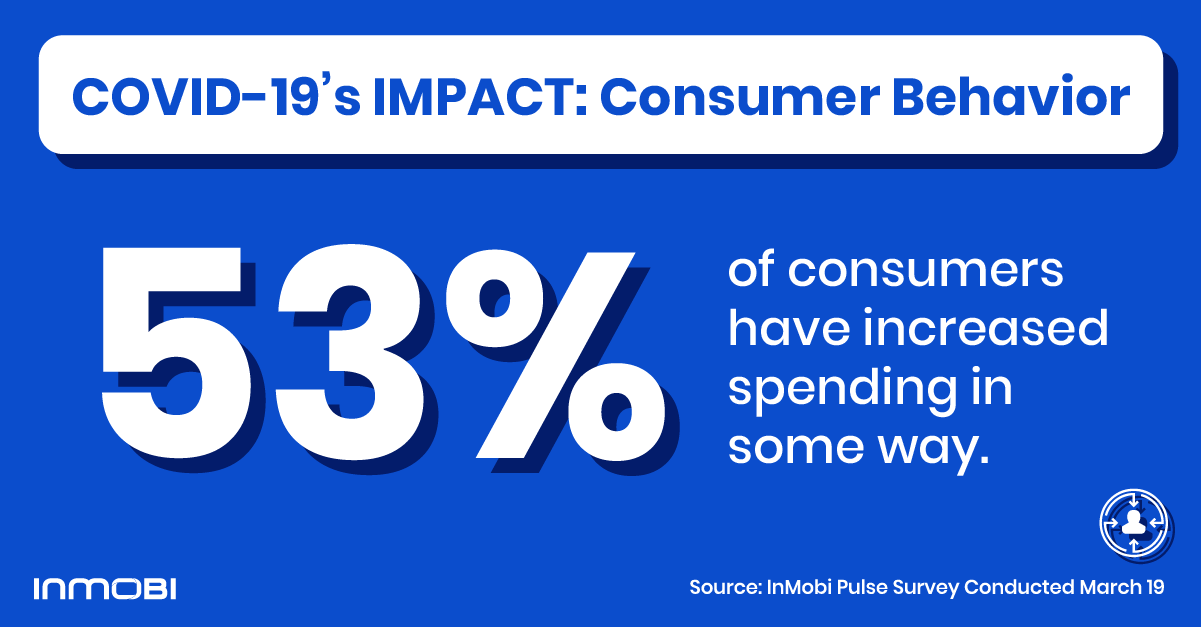

Over half of consumers have increased spending in some way — even more so among younger generations (over 60% for those 18-35). Consumers are spending more on groceries (37%) and household care items (18%), followed by pet supplies (8%).

Households with kids are shopping significantly more across almost all categories compared to households without kids. For those with children, a larger share increased spending (63%), particularly on groceries (44%), household care items (19%), beauty and personal care products (7%) and pet supplies (8%).

Consumers age 18-25 are generally more likely to have increased spending compared to other age groups, especially on Wi-Fi/mobile data plans. Those between the ages of 26-35 are spending more on pet supplies than other age groups.

Around three-fourths of consumers have decreased spending in some way. Consumers are spending less money on entertainment (36%), travel (37%), clothing (30%) and transportation (27%). Compared to men, women have decreased spending significantly more in purchases of beauty and personal care, clothing, shoes and jewelry.

Approximately a third of consumers are shopping online more frequently, buying groceries (13%), household care items (10%) and pet supplies (6%) this way. Based on our survey data, consumers age 36-45 have increased online shopping more than other age groups, especially for groceries, household care items and pet supplies. Compared to women, men are shopping online significantly more for baby products, bank loans, electronics and entertainment. Females are shopping online significantly more than males for beauty/personal and household care items.

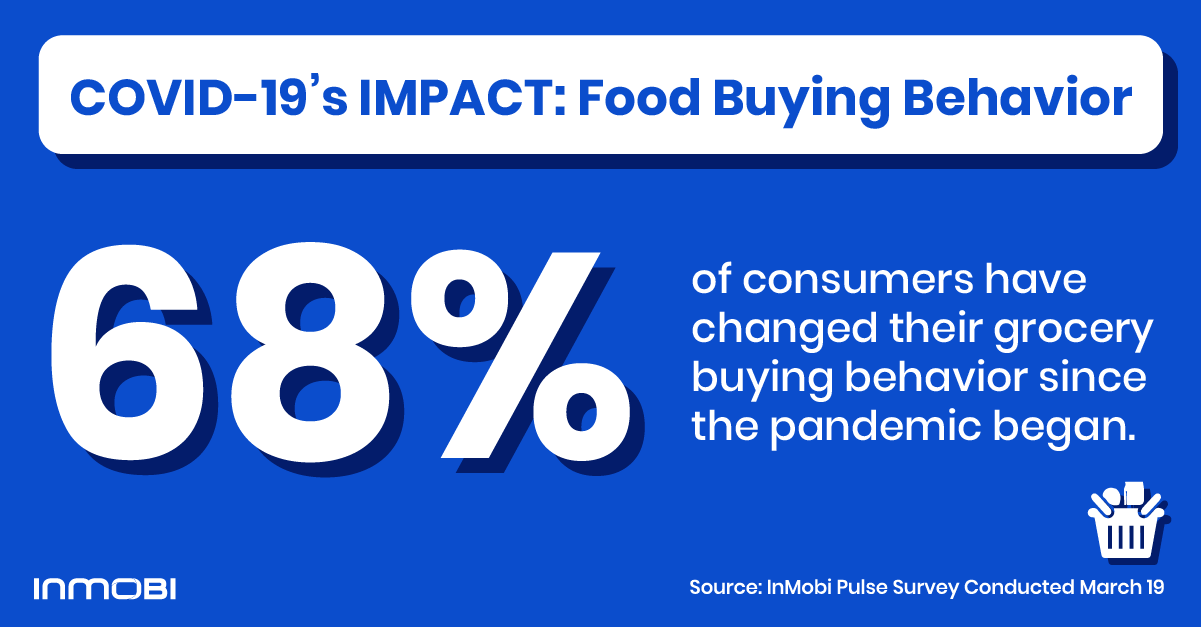

According to the survey, 68% of consumers have changed their grocery buying behavior since the pandemic began. In particular, 46% said they bought enough groceries for a few days, with 18% saying they had stocked up enough for a month. Significantly more women than men stocked up on groceries for a month, while men overall were significantly less likely to change their grocery shopping behavior.

In terms of eating habits, 37% of consumers polled said they stopped eating at restaurants, while 27% said they started cooking at home. Overall, only 7% of consumers increased delivery/takeout orders.

Food delivery behavior is different by age and gender. According to the survey, men have increased delivery/takeout orders significantly more than women have at the moment. In comparison, women have started cooking from home significantly more frequently than men and have reduced or stopped ordering takeout or delivery. Among consumers age 18-35, over one in 10 have increased delivery/takeout orders, a percentage that is significantly more than other age groups.

According to the survey, 69% of consumers have changed their media consumption patterns as a result of the virus. Overall, 38% of survey respondents said they are watching more news, although younger people are watching news significantly less than other age groups.

Further, 20% said they are watching more live TV (cable/satellite), while 25% are streaming more TV. According to the survey, 29% of those age 66 and older said they are watching more live TV now.

Significantly more women than men report changing their media consumption as a result of COVID-19. Among female survey respondents, 41% said they’re watching more news, 21% said they were watching more live TV and 21% said they’re reading more books.

But when it comes to media consumption today, mobile takes the cake. Overall, 73% of consumers said they are spending more time using their mobile phone. Among this group, 41% said they’re playing more mobile games and 26% said they’re using news apps more frequently and 29% reported using social apps more often now.

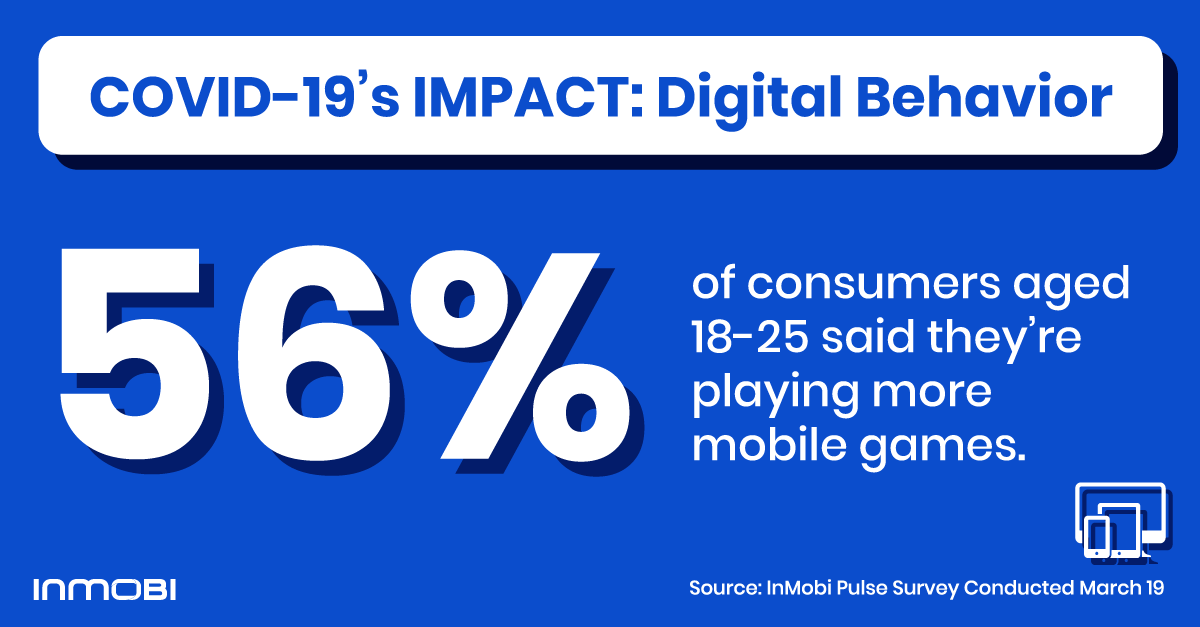

Some of the biggest gains in reported mobile app usage are coming from people between the ages of 18 and 25. Among this group, 56% said they’re playing more mobile games and 43% said they’re using entertainment apps more frequently and 55% reported using social apps more often now.

To stay connected, there has been an increase in messaging, followed by calling. This has been driven more by women than men.

Over a third (35%) of consumers expect their shopping, entertainment or personal behaviors to be impacted by COVID-19 for the next two to three months. Consumers largely (54%) expect all leading economies will be affected.

Register to our blog updates newsletter to receive the latest content in your inbox.