Fuel campaign performance with laser-focused targeting

As we head into the busiest time of the year for retailers in the U.S., what are the biggest retail mobile app trends? With brands and retailers increasingly pushing consumers to download and use their own mobile apps to make purchases this holiday season, who specifically should they be targeting in their app marketing strategies?

To find out, we looked at the data. Using our first-party data sources, we looked at who the current app users are across a number of key retail shopping categories.

Overall, what kinds of trends are we seeing in regard to app installs for major retail categories? Here’s what the data highlights for the toy, home electronics, apparel and beauty sectors.

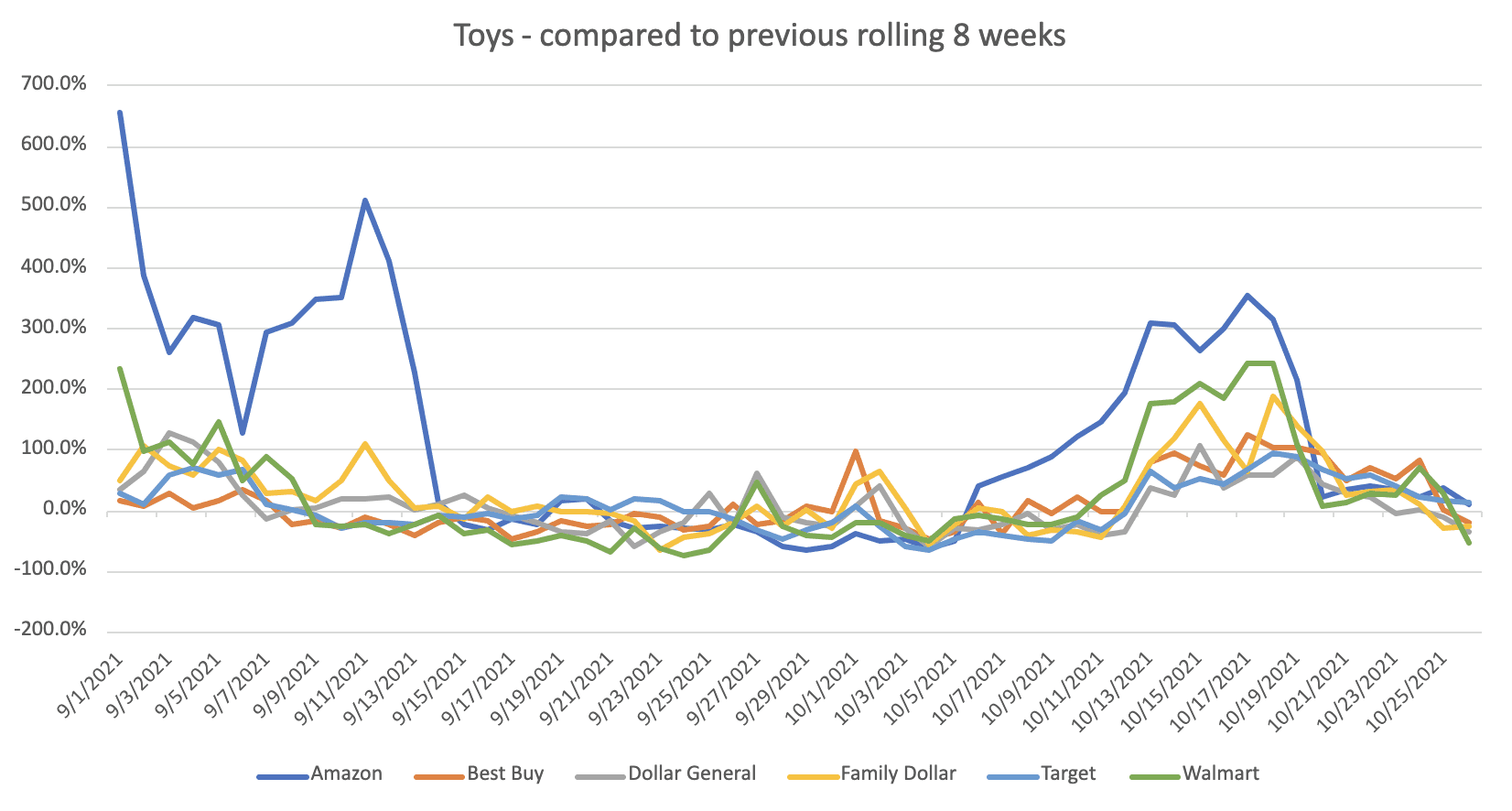

Daily net installs are on the rise for Amazon and Walmart. Other brands have experienced some recent lifts but are largely flat.

Compared to 2020, September installs are down. The trends we’re observing for October 2021 are on par with what we saw in October 2020 for app adoption for most of these brands, with adopting being especially strong for Family Dollar, Dollar General and Amazon.

Installs during the past eight weeks are on the upswing compared to the preceding eight weeks. What this means is that adoption is increasing at an increasing rate.

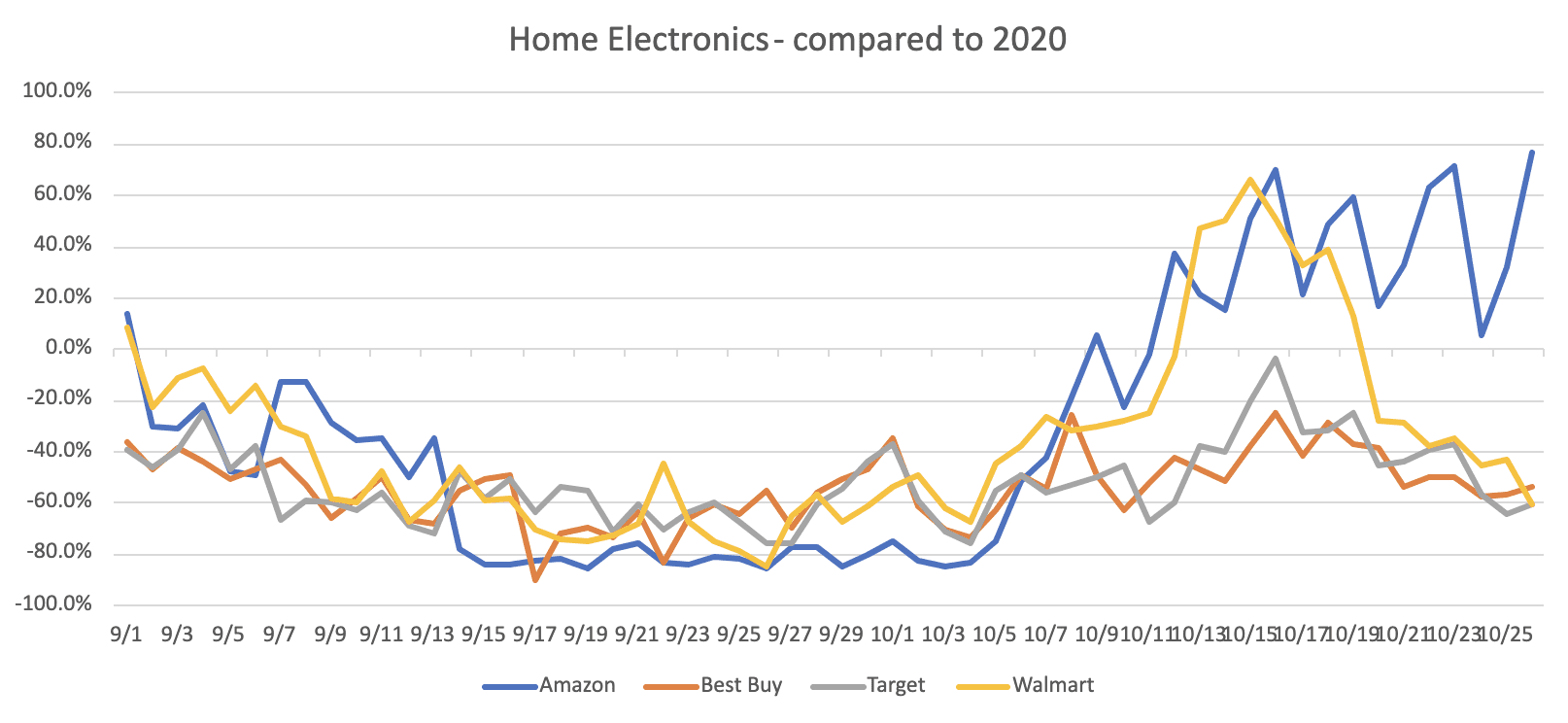

Daily net installs are on the rise for Amazon and Walmart. Other brands are largely flat.

Compared to 2020, September installs are down. October 2021 drover stronger install growth than 2020 for Walmart and Amazon, but Best Buy and Target still lag behind 2020 adoption despite recent growth.

The past eight weeks of installs show an uptick in adoption in mid-October compared to the preceding eight weeks. This means adoption is increasing at an increasing rate.

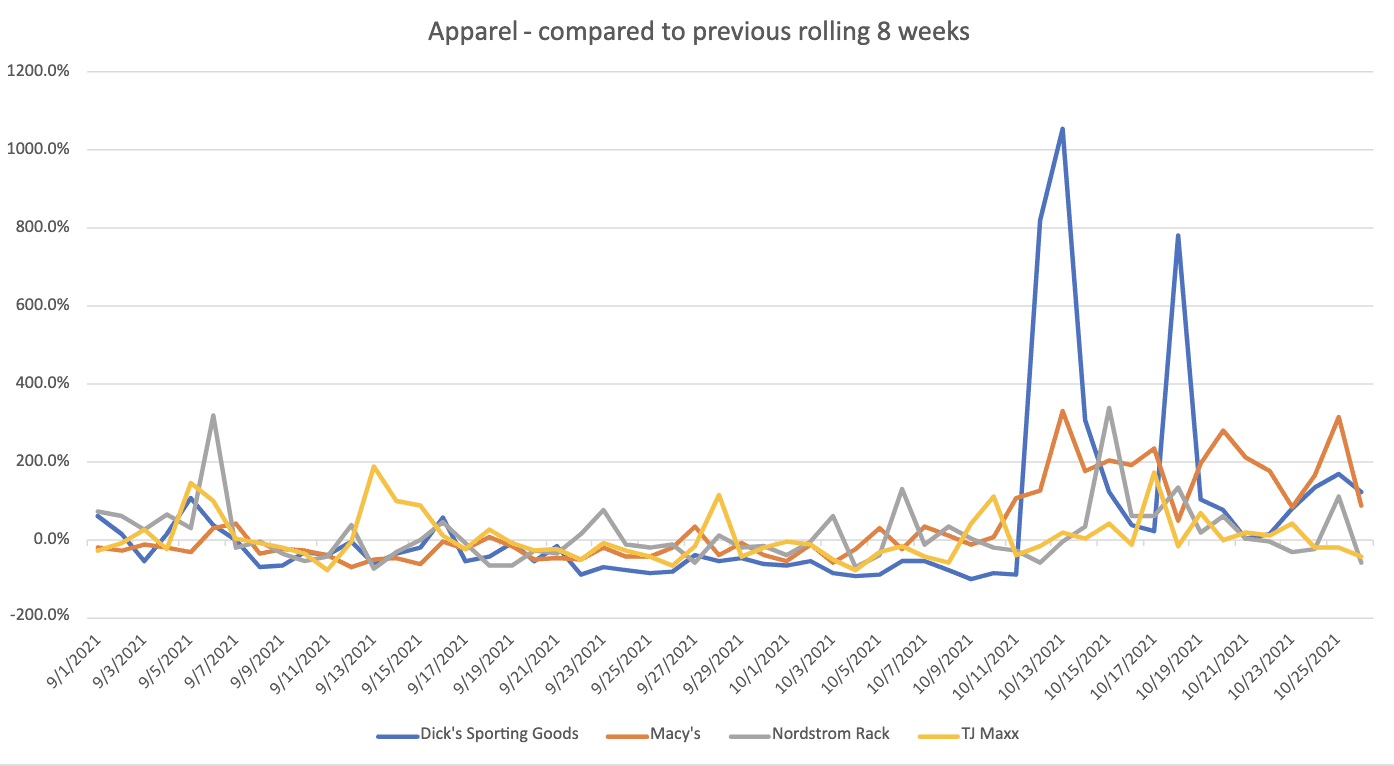

Daily net installs are on the rise for apparel brands. But, except for Dick’s Sporting Goods, 2021 net installs are flat compared to 2020.

What differentiates Dick’s in this space? They ran a 20% coupon that successfully drove installs in late September.

Still, this category is on the upward swing of late. The last eight weeks of installs shows a strong lift in October adoption compared to the preceding eight weeks. For major apparel brands, adoption increased at an increasing rate in October.

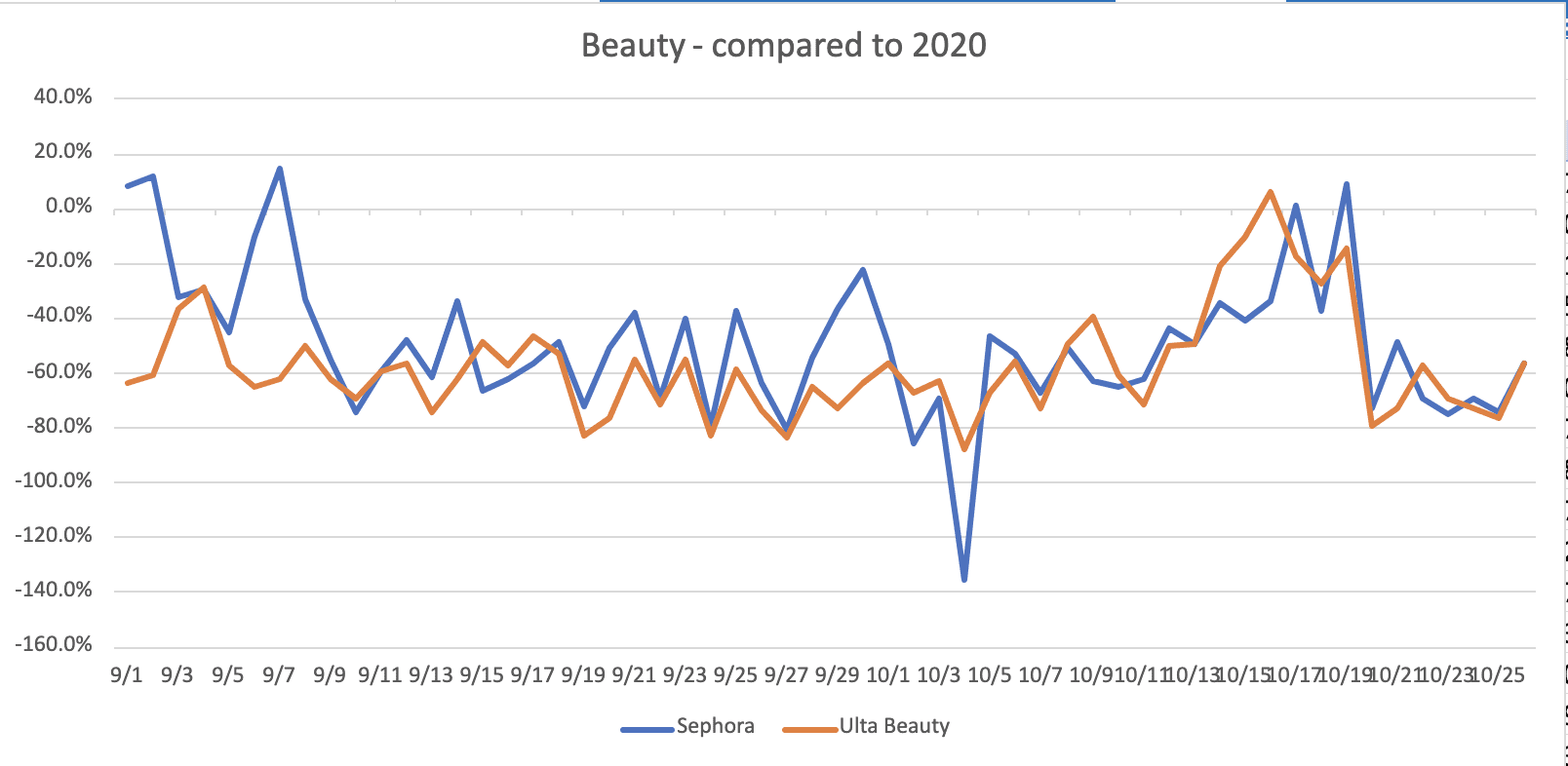

Daily net installs for Sephora and Ulta are growing in September. Ulta is growing at a stronger rate than Sephora, however.

Both apps have seen their net install numbers spike and dip in 2021. Why? These fluctuations are likely due to app-related promos.

Compared to 2020, installs in September and October 2021 are down with the exception of a couple very small lifts in early September and mid-October. Overall, installs in the past eight weeks are flat, with similar growth to the eight weeks prior.

What kinds of shoppers have these retail apps on their smartphones and tablets? To explore this question further, we turned to the data. Here’s what we uncovered about retail app ownership trends in the U.S. in October 2021.

As retailers head into the thick of the holiday shopping season in the U.S., how should they be thinking about their apps? Specifically, how can apps help facilitate a seamless customer experience, and how can retailers lean into app-commerce this year? Based on the data, here are some of our top recommendations:

Highlight how the app makes it easy to buy, period. While some consumers will prefer to shop online, others may prefer to browse and buy at brick-and-mortar stores – and still others will want to pick up their digital shopping cart purchases in a physical store. Consumers want choice and ease this holiday shopping season; brands that highlight how their apps give consumers choice will see both strong app adoption and strong sales as a result.

This is just a small sample of the insights we have generated leading up to the 2021 holiday shopping season. For more detailed insights, including data unique to you, reach out today to schedule a chat.

What do you think the 2021 holiday shopping season will look like, and what will brands and retailers need to do in order to see success this year? Let us know your thoughts on the topic on social media! Whether you want to talk about macro m-commerce trends or even the fine points of push notifications, you can reach out to us on LinkedIn, Twitter, Facebook or Instagram.

Matthew Kaplan has over a decade of digital marketing experience, working to support the content goals of the world’s biggest B2B and B2C brands. He is a passionate app user and evangelist, working to support diverse marketing campaigns across devices.

Register to our blog updates newsletter to receive the latest content in your inbox.