Fuel campaign performance with laser-focused targeting

In late April 2021, with the release of iOS 14.5, Apple officially began enforcing its App Tracking Transparency (ATT) framework. With ATT, all mobile apps that collect and share device-level information are required to display a set prompt that asks end users if their IDFA (Apple’s identifier for advertisers) can be collected and shared.

This is a big change, as previously the IDFA underpinned much of the individualized and highly targeted mobile in-app advertising ecosystem for iOS. Prior to iOS 14.5, everything from attribution and audience segmentation to fraud checks and even frequency capping relied on IDFAs.

By June 22, 2021, around 70% of all Apple mobile devices were running on iOS 14.5 or higher versions. This means that the vast majority of the always important Apple mobile ecosystem would soon not be addressable at the individual device level any longer.

At this stage, all advertisers running in-app campaigns need to deal with these changes. But what next steps should brands take? Here’s what we recommend.

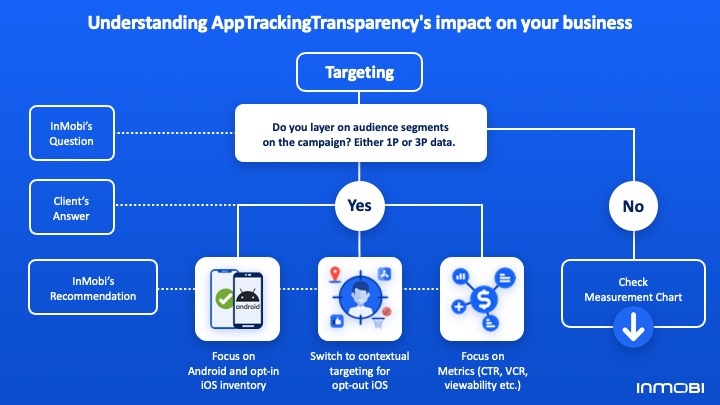

To determine the best next steps, first consider whether any audience segments and/or audience-level targeting are used in the campaign – this includes both first-party and third-party data segments. If yes, then consider these three steps:

Focus on Android and opted-in iOS inventory, as in these environments business continues as before. Even though iOS is the most popular mobile operating system in places like Japan, the combination of these two audiences is still quite significant. For one, there are expected to be more than 131 million Android smartphone users in the U.S. in 2021. In addition, right now InMobi's global iOS opt-in rate was at 30% by the week of June 20. Considering a 25-30% opt-in rate for US, that's still equivalent to 30 million people on iOS, putting the combined total addressable market at more than 160 million devices. And in Android-first markets like India and Indonesia, the total numbers are even greater.

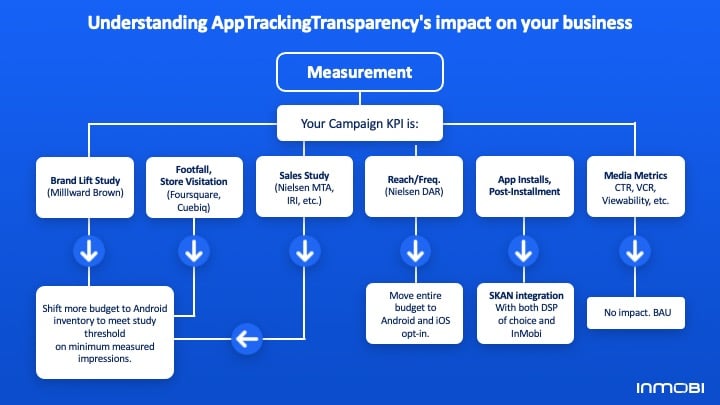

For advertisers not leveraging audience segments, it’s important to note that ATT can impact measurement as well. But ideal next steps here will vary depending on the key performance indicators being tracked.

Advertisers using brand lift studies, footfall data, store visitation information and/or sales studies, the best bet in the short term is to shift budgets towards audiences that are actually addressable at an individual/device level, namely Android users and opted-in iOS users. The same goes for advertisers measuring success through reach and frequency, like through Nielsen DAR.

Campaigns focused on app installs or any post-install activity will have to be measured by SKAdNetwork, which is Apple’s in-house, privacy compliant measurement and attribution solution. Just about all demand-side platforms (DSPs) now support SKAdNetwork, including InMobi DSP.

For advertisers that measure success through media-focused KPIs like CTR and VCR, nothing changes. Even with the advent of ATT, these advertisers can continue life as normal. Considering that many mobile marketers run campaigns centered around these media metrics, this means that a significant chunk of brands will largely be unaffected by Apple’s changes.

For advertisers working in markets dominated by iOS, shifting budgets towards Android only makes sense in the short term. The audience using iOS is too big and too valuable to ignore for too long. As time goes on, advertisers will have to shift their budgets back to iOS, using technology like SKAdNetwork alongside tactics such as contextual targeting and running campaigns based on media metrics like CTR and VCR.

Part of the reason why a shift in budget is only a short-term solution is that 1) eventually Google will implement similar privacy-focused changes in Android and 2) more laws will come on the books in the next few years that will apply privacy rules across the board. As such, it behooves brands to use this time to determine how best to reach and influence consumers where they are in a way that respects their privacy.

So where is the industry headed? What’s on the horizon now that iOS 14.5+ has reached critical mass? For one thing, it will likely lead to the greater use of universal IDs/identity solutions in ad buying. With addressable audiences becoming more disjointed, advertisers will need a more overarching, omnichannel view of their consumers. Advertisers can no longer rely on one channel being universally addressable and suitable for their needs. With universal IDs, ad buyers will be able to better understand their audiences across media. And advertisers who invest in first-party data collection and media activation solutions will tide this better than those who don’t.

This new privacy-first focus also puts a greater value on publisher first-party data. With audience data now at a premium, any insights that a publisher can provide on its own users will be readily received by advertisers. Expect publishers to embrace a more walled garden approach to their own apps, as they will find value in emulating the approach of Google, Amazon and Facebook in terms of owned audience insights.

As the industry evolves, InMobi is here to help. Interested in learning more? Reach out today to speak with one of our mobile experts.

Register to our blog updates newsletter to receive the latest content in your inbox.