Fuel campaign performance with laser-focused targeting

We’ve partnered with Tenjin to produce a report focused on key aspects of the ad monetization market in October 2022.

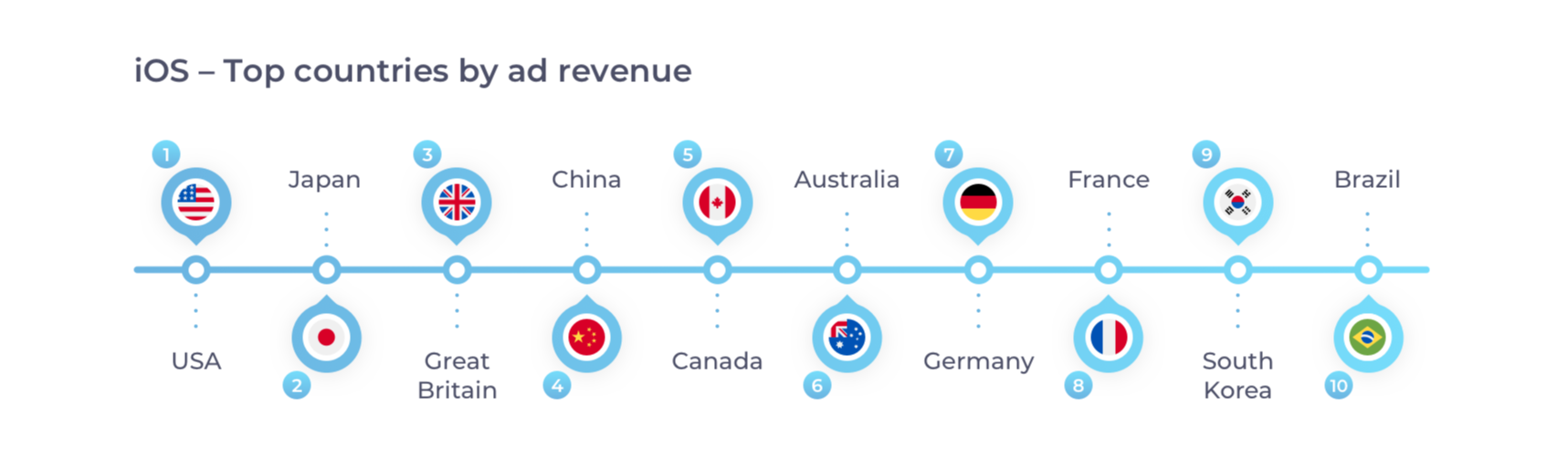

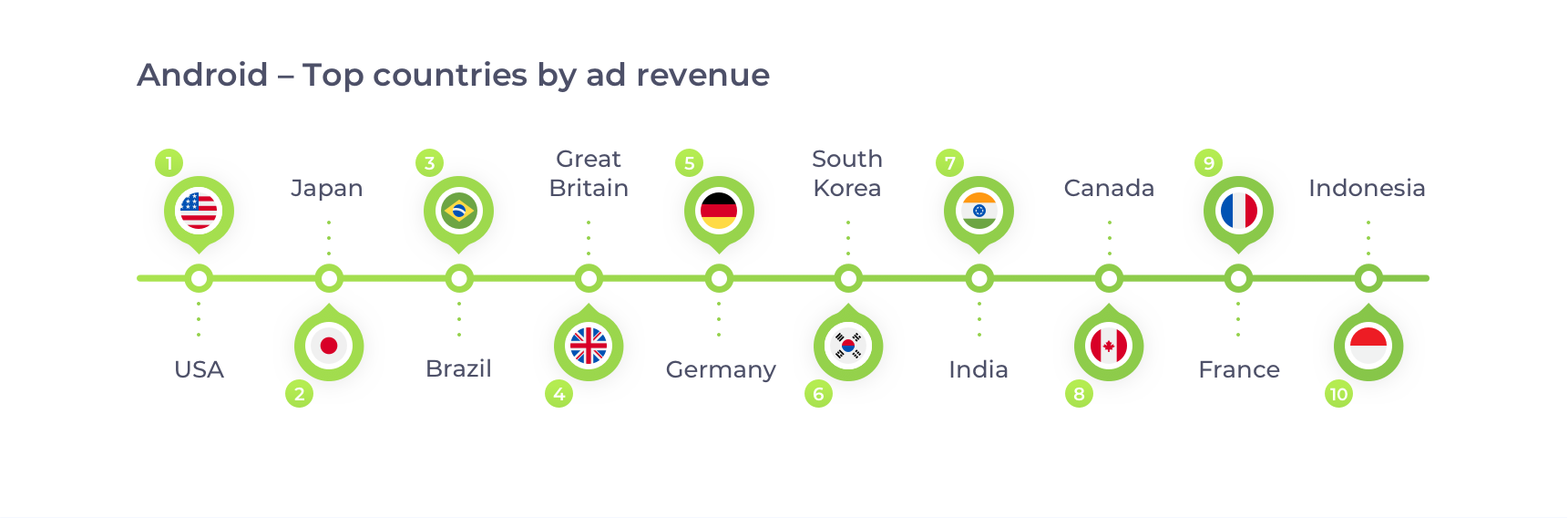

Tenjin’s data shows a healthy revenue and impression distribution between the two operating systems. Being a leading monetization partner for app developers across the world, it’s no surprise to find a mix of countries from North America, South America, EMEA, and APAC as our top revenue markets.

Building on Tenjin’s trends, InMobi has traditionally performed well in other markets like Vietnam and Mexico.

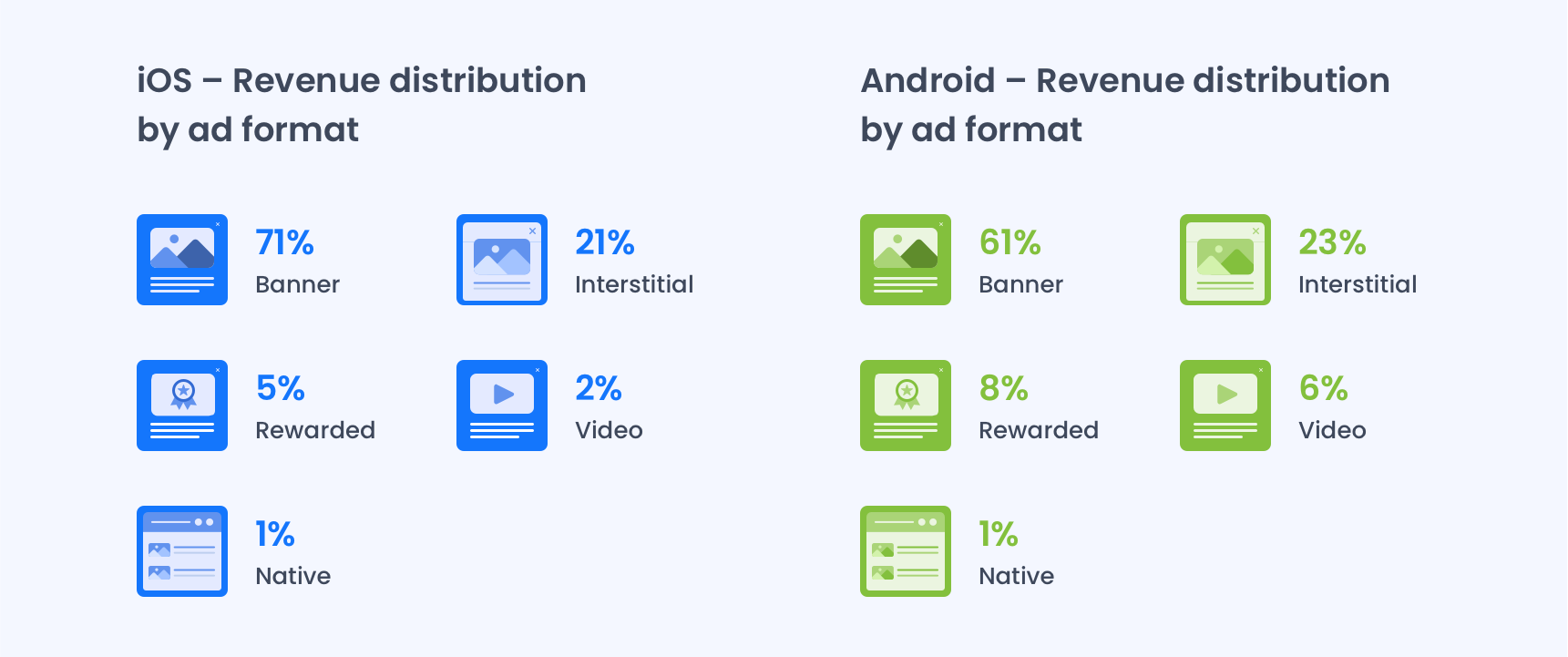

These numbers are a global average across the SSP, therefore they will vary by region and by publishers. While a majority of our inventory across both OS is on banner ads, 40% of Android and 30% of iOS revenue is generated through non-banner inventory such as interstitial and rewarded ads. In fact, some of our larger publishers see 40%+ of revenue on full screen.

With users preferring more and more opted-in formats like rewarded video, we have seen tremendous growth on full screen placements. Full-screen inventory ad requests for the InMobi Exchange grew by 173% and 38% in revenue in Q2 ’22 as compared to the previous year. You can take a look at our rewarded video growth here.

We also expect our native inventory and revenue to growth exponentially as we’ve just announced our closed beta for native ad monetization on our header bidding integration with AppLovin MAX. We now also support native ads on Google Open Bidding for both app and mobile web.

Effective September 30, Google’s new Ads' guidelines bans full screen interstitial ads that show unexpectedly and that are not closable after 15 seconds and interrupt users in their actions.

While the policy invites better ad practices, the gaming developer ecosystem was certainly wondering about a potential impact, especially across the hyper-casual category.

However, looking at the data at global level we only found a 2% decrease in eCPMs across Android, which is linked to seasonality. We also saw a steady growth of 9% in revenue and 5% in impressions, concluding that the new ad guidelines are not leading to a high impact based on the trend we see right now.

Overall, we at InMobi welcome guidelines that focus on user experience. We believe that this will enable a better experience for the users and eventually drive higher and better engagement.

Download the full report here.

Register to our blog updates newsletter to receive the latest content in your inbox.