Segmenting Audiences to Enable Precision Targeting

The brand factored in custom audience cohorts based on demographics comprising of men and women aged between 18 to 34 years. Kredivo opted in for hyperlocal targeting and charted out three cities in Indonesia with the highest online shopper base; the capital city area - Jabodetabek, the second biggest city - Surabaya, the nearest city to the capital - Bandung, to conduct the study with a huge sample size of 6.000 respondents, accurately matching the brand's criteria.

Cracking the E-commerce Shopper Genome on Mobile

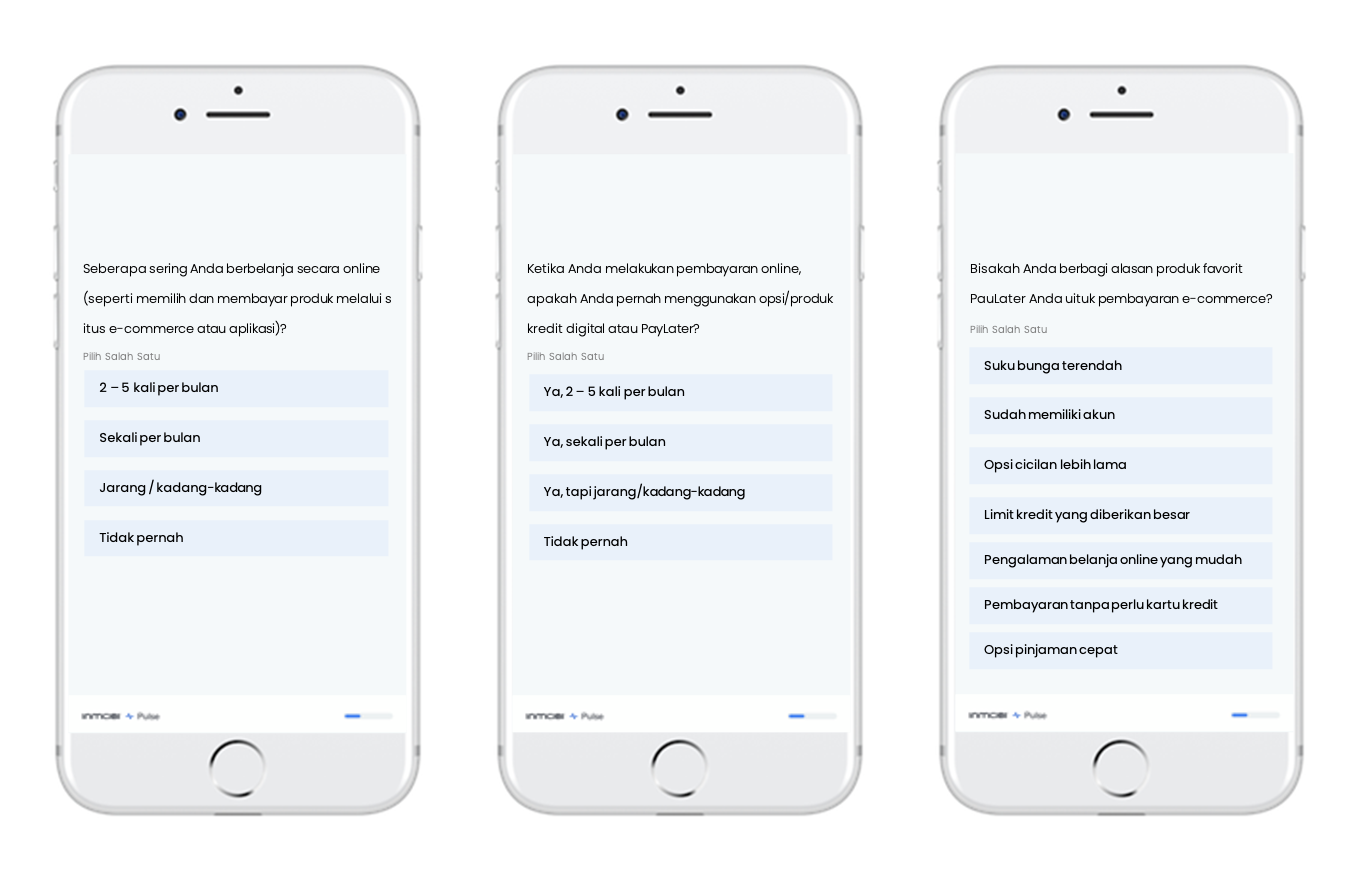

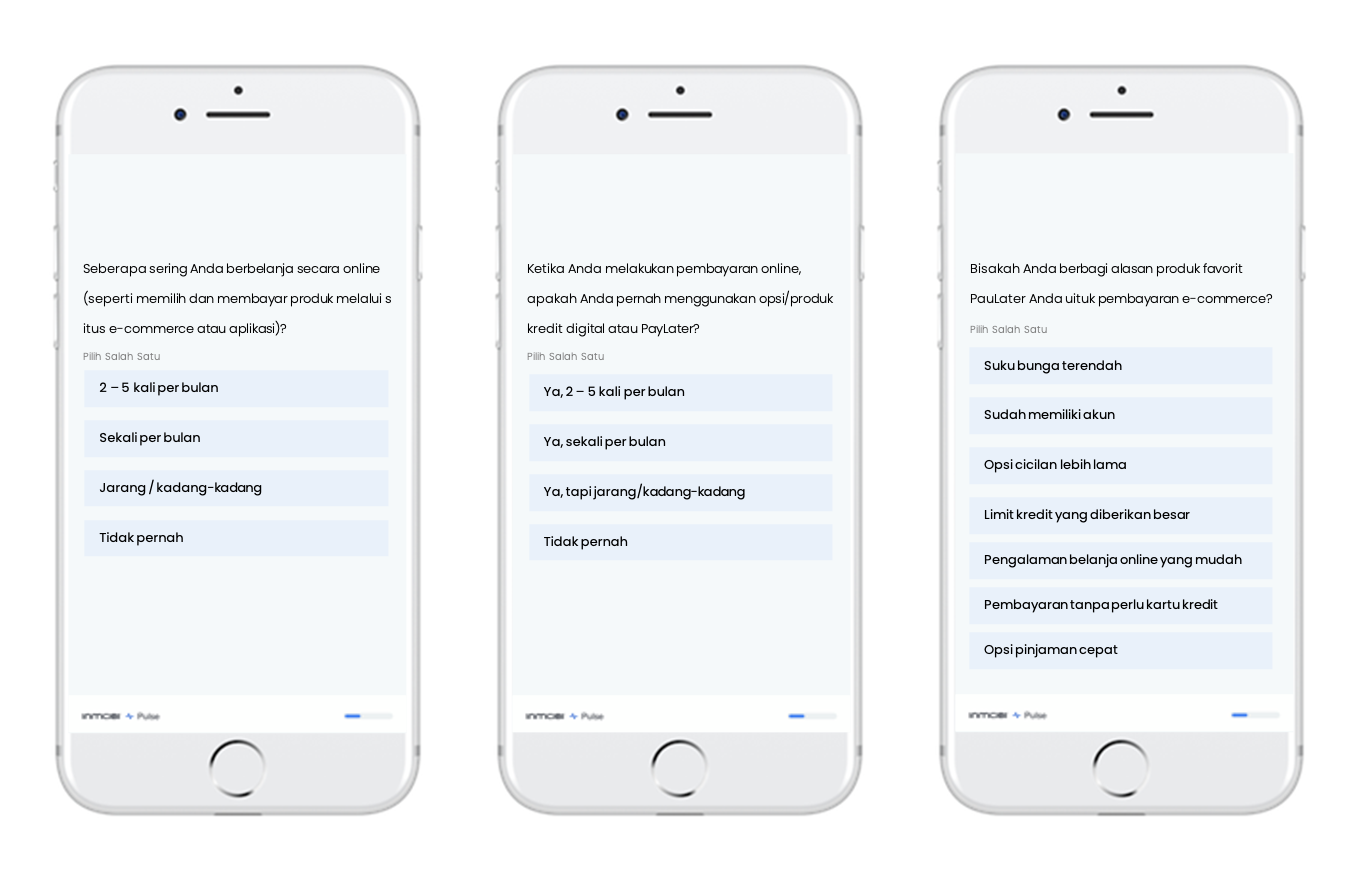

To begin with, it was pivotal for the brand to identify the patterns of e-commerce purchases in Indonesia. The survey included questions on the frequency of online shopping of these cohorts, followed by how frequently they used online payment options such as BNPL. By assessing the shopping frequency, the brand could ascertain the pre- and post-pandemic changes in online shopping patterns and payments of the connected consumers in Indonesia.

Measuring the Brand Performance in a Competitive Market

Kredivo measured the brand performance in a competitive context and understood its strong and weak demographic cohorts, key product features, and communication hooks that drive product adoption and differentiating aspects that drive consumer loyalty. By factoring in the consideration metrics that would enable online payments such as credit limit, interest rates, association with the brand, installment options, seamless shopping experience, flexible payment plans, and data security, Kredivo deconstructed the features that consumers consider the most important when making payments.

The Result

1) Key Metrics Identification: By considering over ten different consideration metrics that enable consumers to make online payments, the brand could redesign and optimize its consumer communication plan.

2) Brand Affinity: The competitor analysis helped Kredivo understand their market position and the consumer's affinity towards different brands in the market, and the reasons why they prefer a brand.

3) Competitive Context: Kredivo could identify the unique differentiators and key performance trends against the competitors and devise their performance strategies accordingly.

4) Granular Insights: The brand could narrow down to niche demographic and location level filters to truly reach audiences that matter and get insights that help.

5) The Response Quality: With 30+ checks by advanced AI algorithms, InMobi Pulse validated the most genuine surveys in real-time to ensure high response quality.