- For Advertisers

-

For Publishers

- For Retail Media

- For Telcos

- Our Consumers

- Resources

- GET STARTED

-

Login Login

When Apple launched its AppTrackingTransparency (ATT) framework, Apple’s SKAdNetwork (SKAN) became a familiar term and attribution framework for app performance advertisers. However, there was early hesitancy to this change as advertisers lost the ID-level deterministic targeting and measurement they had been so used to.

So how is adoption looking as we approach the second anniversary of ATT and SKAN? What is impacting adoption? What are the future milestones that might drive adoption further? These are all questions we’ll look at in this post.

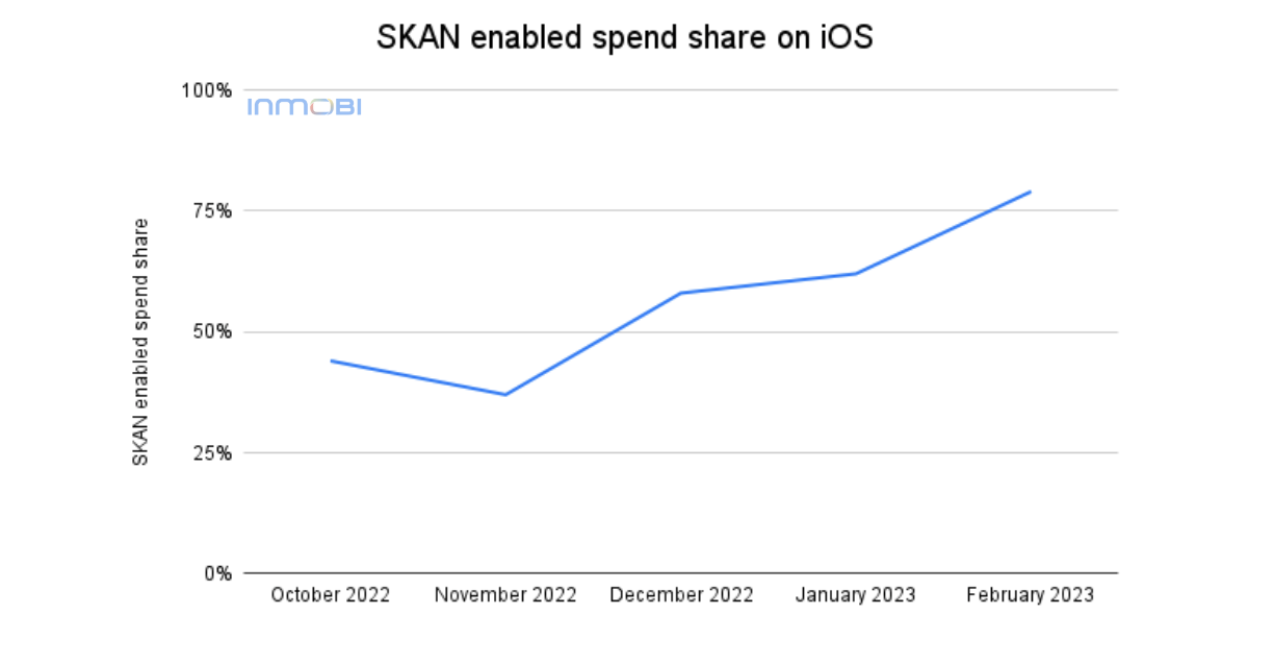

Let’s start by looking at some indicators of how advertiser adoption of SKAN has been going. If we look at SKAN-enabled spend on InMobi’s DSP globally, we see it becoming a steadily increasing percentage of iOS spend.

After SKAN 4.0 – a far more complete attribution solution – was released in October, advertisers clearly saw a need to start using SKAN more widely. SKAN's share then broke through 75% for the first time in February of this year.

While SKAN advertiser adoption is now on a charge, the data does show some initial hesitancy from advertisers. So what were the reasons behind this? In-market, we have seen three major themes in advertiser conversations:

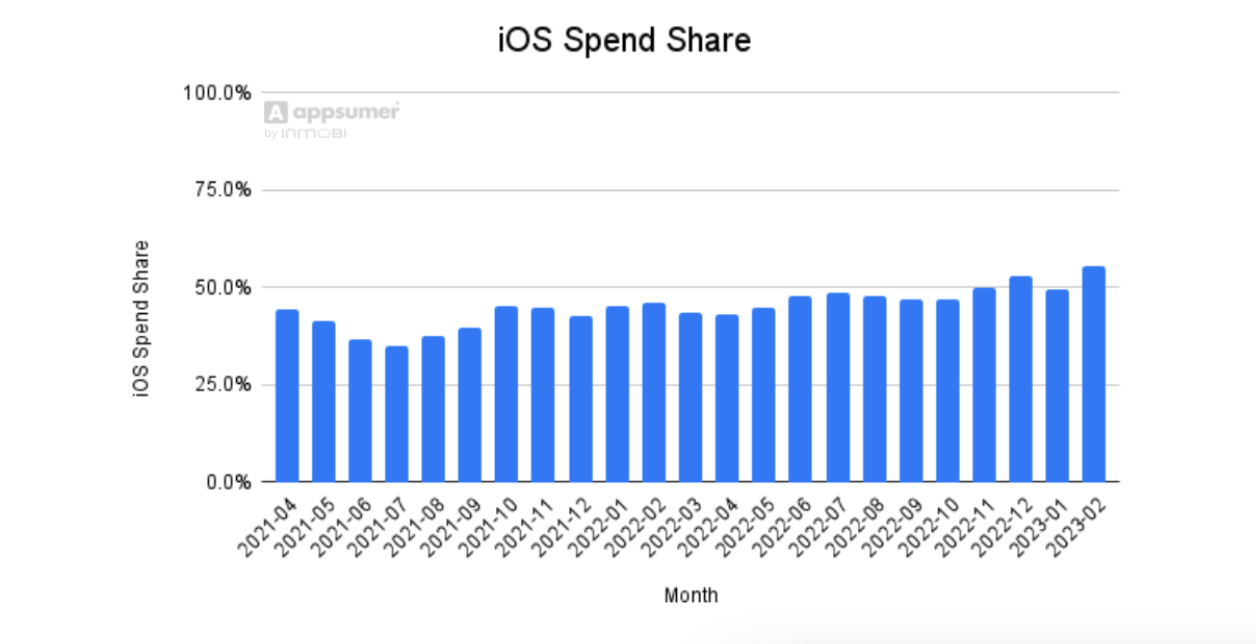

Android spend increases: On Android, advertisers still have access to the GAID, unlike on iOS where Apple’s IDFA became opt-in with ATT. This meant that many advertisers shifted more of their attention and investment to Android after ATT was launched in Spring 2021, as they still had the user-level deterministic measurement and targeting they were used to. This aggregate data from InMobi’s cross-channel optimization platform Appsumer shows that initial decline in iOS budget share post-ATT to a low of 35% in July 2021.

What we see here is that the initial switch to Android has begun to reverse from a low of 35% back to, and above, a 50% share of wallet over the last four months since SKAN 4.0 was released.

Fingerprinting / probabilistic attribution: While Apple very clearly banned fingerprinting / probabilistic attribution in its developer terms of service, at a technological level, they have not clamped down heavily, yet. So some advertisers have taken the “make hay while the sun shines approach,” using fingerprinting as an alternative for user-level identity to the IDFA on iOS.

Early SKAN shortcomings: Early versions of SKAN undoubtedly left a lot to be desired for advertisers. To name a few:

However, market changes mean advertisers can no longer hesitate in many of these areas. For many advertisers this is motivating them to invest resources into the increased adoption of the SKAN measurement methodology.

If we look at each of these areas of hesitancy, there are key milestones incoming that create urgency for advertisers around SKAN:

What we really see is that advertisers are beginning to adopt SKAN in earnest, and there are drivers that are likely to push this trend even further in the coming year. So the time has really come for advertisers to come to grips with SKAN 4.0 and start implementing an effective targeting and measurement strategy for this new privacy-first world.

That’s why our team has been compiling some of the most complete resources for advertisers who are looking to accelerate their SKAN 4.0 adoption, including:

For help with your SKAN adoption journey, reach out to our team of SKAN experts at performance@inmobi.com. We’d love to hear from you – and remember, no question is too basic when it comes to learning how to navigate Apple’s SKAN 4.0.

Register to our blog updates newsletter to receive the latest content in your inbox.